The TheologyOnline.com TOPIC OF THE DAY for November 15th, 2012 08:32 AM

Take the topic above and run with it! Slice it, dice it, give us your general thoughts about it. Everyday there will be a new TOL Topic of the Day.

If you want to make suggestions for the Topic of the Day send a Tweet to @toldailytopic or @theologyonline or send it to us via Facebook.

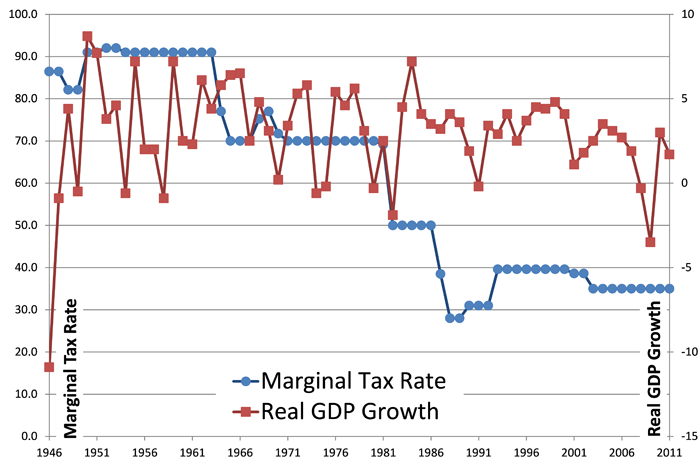

| toldailytopic: Is increasing taxes on the wealthy a wise economic plan for this nation? |

Take the topic above and run with it! Slice it, dice it, give us your general thoughts about it. Everyday there will be a new TOL Topic of the Day.

If you want to make suggestions for the Topic of the Day send a Tweet to @toldailytopic or @theologyonline or send it to us via Facebook.