While both political parties fiddle and spend massive amounts of money while the US burns banks and credit card companies are deactivating credit cards, slashing limits on all types of cards, and generally making credit very scarce for the consumer. Wonder why?

There are such hard times coming that the above numbers are going to look puny long before this is over. What we are going to see is a credit collapse in which any type of borrowing is going to become extremely difficult. So if you are using credit cards to buy groceries because you're struggling financially, that option will not last very long.

The rest of the article can be found here.

While the Federal Reserve and the Trump administration plow trillions of dollars into corporate America, buying investment-grade bonds and rocketing the stock market to new highs, there's a much different story playing out of economic hardships for the everyday American.

There's a massive pullback by credit card issuers at the moment, reducing credit limits and canceling accounts of consumers.

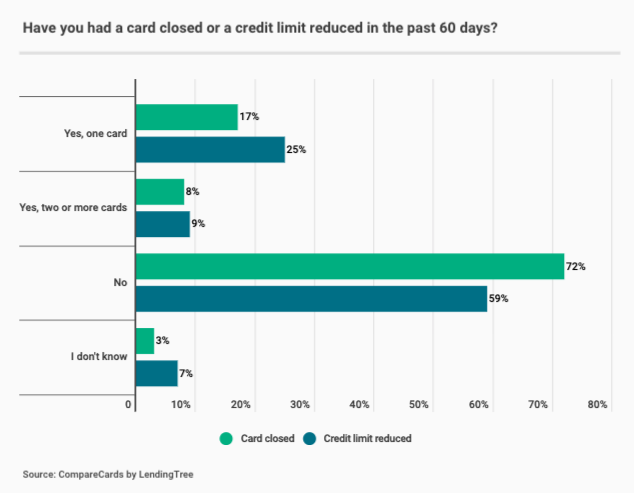

CompareCards' new survey shows the economic fallout from the virus-induced recession is far from over. About 25% of Americans with credit cards had an account involuntarily canceled between mid-May to mid-July, while 33% said card companies slashed their credit limit.About 70 million people – more than one-third of credit cardholders – said they involuntarily had a credit limit reduced or a credit card account closed altogether in a 60-day period stretching from mid-May to mid-July.

The report is a clear sign that credit card issuers are still closing cards and reducing credit limits on cardholders in huge numbers, months after an April 2020 CompareCards survey showed that nearly 50 million cardholders had a card closed or credit limit reduced in the first month in which the coronavirus pandemic took hold of the country. - CompareCards

Matt Schulz, the chief industry analyst at CompareCards, told Yahoo Money that "an awful lot of Americans had one of their financial security nets taken out from under them in one of the most difficult economic times in American history."

The pullback by credit card companies was last seen during the Great Recession when about 16% of cardholders saw limits reduced and accounts involuntarily closed."This is, in a lot of ways, a much bigger issue today than it was in the Great Recession," Schulz said. "It makes sense that banks are taking an even harder line with lending because there's so much that they don't know, and they're so nervous about risk."The key takeaway from the survey is that card closures and credit limit reductions continue through summer, even though the Trump administration promotes a 'rocket ship recovery' in the economy.

-

There are such hard times coming that the above numbers are going to look puny long before this is over. What we are going to see is a credit collapse in which any type of borrowing is going to become extremely difficult. So if you are using credit cards to buy groceries because you're struggling financially, that option will not last very long.

The rest of the article can be found here.