Where would the ruling class get its political campaign funds, if not from the wealthy?

:chuckle:

Hmmmm. Good point, although I'd say the ruling class are the wealthy.

Where would the ruling class get its political campaign funds, if not from the wealthy?

| WASHINGTON (AP) — President Barack Obama makes it sound as if there are millionaires all over America paying taxes at lower rates than their secretaries. "Middle-class families shouldn't pay higher taxes than millionaires and billionaires," Obama said Monday. "That's pretty straightforward. It's hard to argue against that." The data tell a different story. On average, the wealthiest people in America pay a lot more taxes than the middle class or the poor, according to private and government data. They pay at a higher rate, and as a group, they contribute a much larger share of the overall taxes collected by the federal government. There may be individual millionaires who pay taxes at rates lower than middle-income workers. In 2009, 1,470 households filed tax returns with incomes above $1 million yet paid no federal income tax, according to the Internal Revenue Service. That, however, was less than 1 percent of the nearly 237,000 returns with incomes above $1 million. |

It's amazing how hard some of ya'll work at not understanding.

Yes, the wealthy pay more of the total income tax.

Yes, they pay at a higher rate.

No, they do not pay as high a percentage of their income in taxes as everyone else.

The secretary pays 32% of her overall income in taxes. Her wealthy boss pays only about 25% of his overall income in taxes. So the greater tax burden is on the secretary. This is what Obama and so many others are referring to when they say that the wealthy are not paying their fair share.

It's not about the dollar amount. It's about the burden the dollar amount represents overall.

That's just more corporate propaganda for idiots. What they are calling "economic freedom" is really just commercial lawlessness. These big corporations and their wealthy owners use our roads and sewers and power grids and law enforcement and all manner of national infrastructure, but they don't want to pay for any of it. So they demonize the government to any fool who will buy into their tripe in hopes of creating enough chaos that they can continue to do as they please, without any government oversight. And what they please to do, of course, is take everyone else's money. As much and as fast as they can.As Murray Rothbard pointed out in “The Myth of Tax ‘Reform’;”: “Every economic activity that escapes taxes and controls is not only a blow for freedom and property rights; it is also one more instance of a free flow of productive energy getting out from under parasitic repression.”

Fair share is a highly subjective thing, isn't it?

Uh, yeah. More than a fair share. Besides, God said don't be partial to the poor or the rich man. The tax man should be taking equal from both.

Even the left-wing liberal media can't buy Obama's garbage about the rich not paying their fair share.

Duh the rich pay more taxes than the poor. THEY HAVE MORE MONEY! Even with a flat tax, the rich would pay more in absolute dollars because of the massive disparity in money. Federal income taxes they pay at a higher rate, problem is the super rich don't get much of their income from a W-2. Much of it comes from capital gains which is taxed at a much lower rate.The data tell a different story. On average, the wealthiest people in America pay a lot more taxes than the middle class or the poor, according to private and government data. They pay at a higher rate, and as a group, they contribute a much larger share of the overall taxes collected by the federal government.

I think people know when they're getting screwed, doc. And I think it's clear that the highway robbery we've witnessed over the last few years would've made the thugs and barons of the Gilded Age blush.

Taxes paid by corporations merely add to their cost of doing business. It is consumers and employees that ultimately pay corporate taxes as they are embedded in the prices paid for products and reduce wages paid. The corporate tax is just another of the government’s vehicles by which it masks Americans’ true tax burden.

This is true, I get screwed as well.....all the time. But we get screwed because this is now and has been for sometime, (before I was born) that this is a corporate state. The United States at this time is more in line with fascism.

Obama talks a good game about taxing corporations, but he even knows this is more bull hockey coming from his mouth. Corporations now are more like tax collectors and they pass that added expense to you and I.

Gee except Politifact rates the Warren Buffet story as TRUE.

Duh the rich pay more taxes than the poor. THEY HAVE MORE MONEY! Even with a flat tax, the rich would pay more in absolute dollars because of the massive disparity in money. Federal income taxes they pay at a higher rate, problem is the super rich don't get much of their income from a W-2. Much of it comes from capital gains which is taxed at a much lower rate.

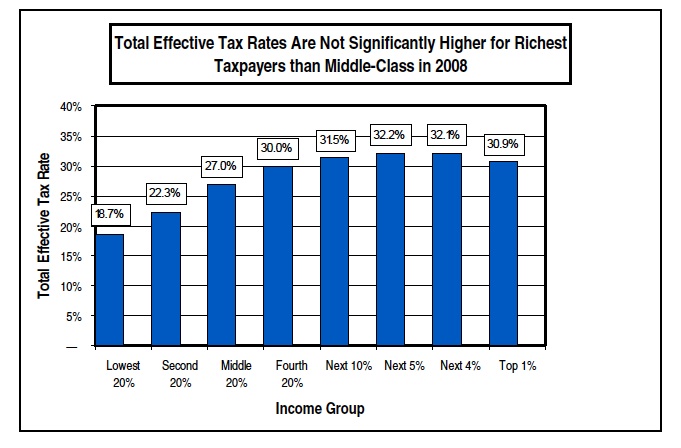

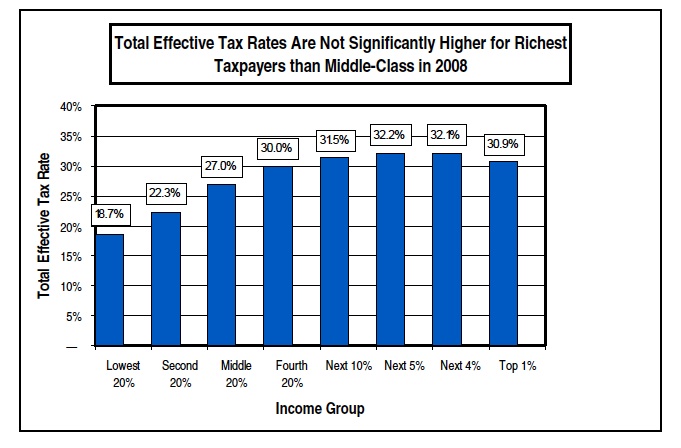

And when you count total taxes (state and local taxes are actually regressive rather than progressive) The tax burden is much flatter than pure federal income taxes would imply.

Average Local and state tax burden for Virginia. (Note that sales taxes are strongly regressive)

(Note that the tax rate actually drops for the highest income earners)

And complaining that the poor pay no taxes, they may pay no federal income taxes, but they certainly pay taxes.

I agree. It didn't come bearing a cross or a flag; it came in Nikes sipping a Coke. USA! USA!

Like every president since JFK he's an empty suit, a messenger, a middle man, a caretaker of the status quo. Their only job is simply not to screw up the program for four or eight years. That's all.

It's whatever liberals say it is, and it's never enough.Fair share is a highly subjective thing, isn't it?

It's whatever liberals say it is, and it's never enough.

It's whatever liberals say it is, and it's never enough.

No matter what side is using what rhetoric the wealthy in this country never bear a burden the same way the have-nots do, so whatever some misled misguided liberal man on the street thinks is really beside the point.